Land is an essential and the foremost commodity for real estate development. Builders and developers buy land, finance real estate deals, plan residential, commercial and leisure schemes to develop projects and build high-rises. In a country where there is already shortage of more than 12 million shelters, adequate supply and suitability of land is more than a must to meet housings demand, especially low-cost housings. However, ongoing surge in land prices in Pakistan has made affordable and low cost housing unaffordable, if not impossible.

Pricy Land vs. Real Estate Development

Land use in Pakistan is largely decided by large developers without any social considerations. Former prime minister Imran Khan last month called real estate as “the biggest mafia in Pakistan”, which “grabs government land, sells it to the general public and then transfers the proceeds abroad.” While in power Imran Khan vowed to develop 5 million low-cost houses to meet out the demand of housing shortage and give impetus to construction industry. But he failed miserably because of unavailability of adequate and inexpensive land.

According to the Pakistan Credit Rating Agency’s report on real estate sector, property prices sizably surged in last couple of years. As from December 2018 to December 2021 residential property prices had surged by 42.7%, housing prices by 43.8% and plot prices by 30.2%. The trend continues and makes housing’ affordability difficult with each passing.

Reasons of Inflation

A senior member of ABAD on condition of anonymity told infocus, “land prices in Pakistan are skyrocketing because of black money being parked in real estate”. He also laments hoardings of properties and land in Pakistan, which makes affordable housings impossible and out of reach for the poor. Another reason to him is the absence of vertical construction trend in Pakistan. “Builders and developers still prefer big housing societies and lavish gated-community schemes, which occupy large amount of land. Rather, if real estate developers build apartments and high-rises, it will bring prices of land down as well as ensure food security”, he opines.

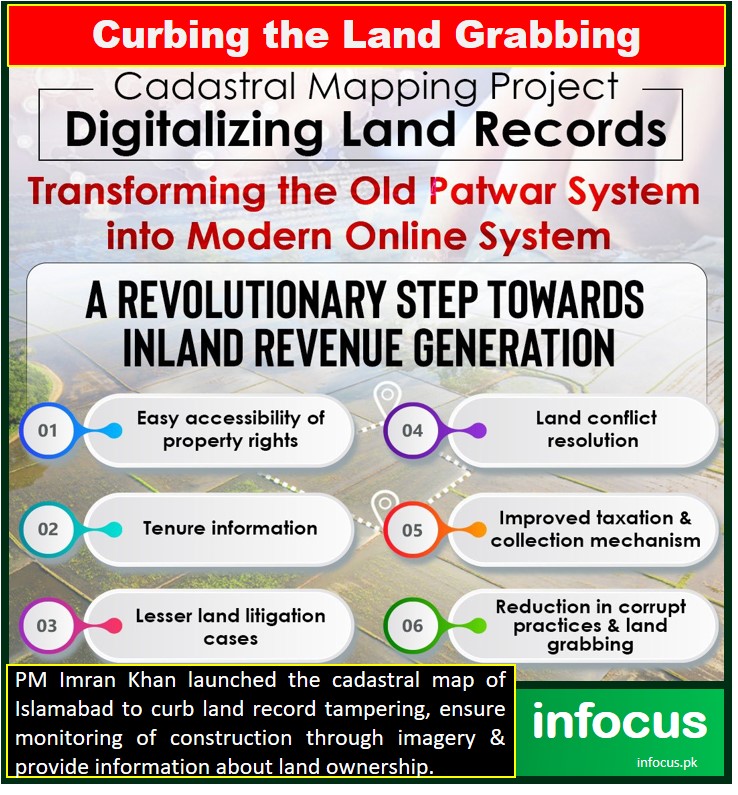

Former Prime Minister Imran Khan, during his tenure, tried some efforts for digitization of cadastral mapping in some regions as well as establishment of a land bank to control land speculation. Together with his housing program, he also patronized and encouraged home financing under Mera Pakistan Mera Ghar Scheme. However, tight standards and strict prerequisites for giving out such loans persisted as a major constraint during majority of the PTI regime, which resulted into further hoarding and inflation in land prices. Besides, transparency and speculation of prices by realtors also led to the rise in land prices and failure of housing program.

Finance Bill 2022

While announcing the Finance Bill 2022 the government introduced a new Section 7E in the Income Tax Ordinance, 2001 as a measure to ensure real estate regulation and transparency. According to the Bill, a person having more than one immovable property which values above Rs25 million shall be treated as 5% of rental income of fair market value. A tax rate at 20% has been imposed on deemed income from immovable properties through a new section introduced to Income Tax Ordinance, 2001.

Through Finance Act, 2022 deemed income on immovable property has been imposed from tax year 2022 (July 01, 2021 – June 30, 2022) and declaration has been made mandatory of the deemed income along with annual return by November 30, 2022. Although many taxpayers approached the higher courts challenging the imposition of the deemed income. But the Sindh High Court through its order late October 2022 rejected the petitions and allowed the FBR to levy and collect the tax.

Impacts of Section 7E on Construction Sector

However, the senior member of ABAD takes Section 7E in Finance Bill 2002 as a positive development. “I personally believe that 7E is the best thing that has happened for the construction industry. Because that will boost construction on vacant plots and reduce hoarding of houses and apartments by the rich as well as reduce parking of black money in real estate.” He is also of the opinion that the Bill will “increase tax revenue, bring down inflation and in the long run reduce the fiscal deficit.” While underlining its positive impacts on construction sector the senior member also says “if implemented in letter and spirit the Section 7E will help poor people to afford home and support the struggling steel, cement, tile and other allied industries too.”

By

Editorial, Infocus